When Obamacare, otherwise known as the U.S. Health Care Reform Act, goes into effect January 1 next year, Americans will be faced with yet another way to find and buy health insurance. For the 50 million who don’t get health insurance through their employers or Medicare or Medicaid or on the private market, they’ll have to buy it through the new health insurance Exchanges. Those who don’t have health insurance and don’t buy it will face a federal fine. Blue Cross, Cigna (NYSE:CI), Humana (NYSE:HUM) and Kaiser among others will sell insurance to those who don’t already have it. They must follow standards set out in the federal act.

For some who are currently buying insurance on the private market, the exchanges may offer lower premiums and lower out-of-pocket costs. Some employers have already announced they plan to end insurance plans for certain employees and instead send them to the Exchanges. October 1 is the first date you can sign up; enrollment ends March 31, 2014. Here are five things you should know about the new Exchanges, also called the Health Insurance Marketplace.

1. There are four health plan categories – Bronze, Silver, Gold and Platinum

The Marketplace plans are separated into four primary levels: Bronze, Silver, Gold and Platinum.

The different levels are intended to meet various health and financial needs, and are based on the percentage that each plan pays towards health care services. The plan levels also indicate the percentage you will pay towards the health care you receive. Your portion of these costs is in the form of:

This chart shows how much the different plans will pay of your health costs, not including premiums:

2. All Marketplace plans must cover Essential Health Benefits

Regardless of whether you choose a Bronze, Silver, Gold or Platinum plan, certain essential health benefits must be covered and your copayments and coinsurance for them count towards your deductible. These services include:

3. You might qualify for lower monthly premiums and out-of-pocket expenses

Many people will qualify for new federal subsidies that can help lower health costs, both the premiums and the care itself. When you get coverage through the Marketplace, you may be eligible for:

In order to take advantage of Cost-Sharing Reductions, you must purchase a Silver plan on the Marketplace and your modified adjusted gross income (MAGI) must fall below these maximums:

FRom: http://www.investopedia.com/articles/personal-finance/091613/5-things-you-should-know-about-new-health-marketplace.asp

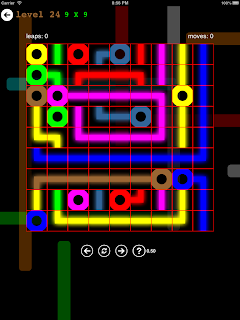

Flow Arrange free puzzle game

#iphone #ipad #appstore #game #itunes #ios7

الحرة لعبة اللغز مجلس التطبيق تحميل

Gratis raad spel wat inligting af te laai

Gratis boord puzzelspel app downloaden

Gratuit bord puzzle game app télécharger

Gratis-Puzzle-Spiel-app herunterladen

Bordo libero di puzzle game App Scarica

For some who are currently buying insurance on the private market, the exchanges may offer lower premiums and lower out-of-pocket costs. Some employers have already announced they plan to end insurance plans for certain employees and instead send them to the Exchanges. October 1 is the first date you can sign up; enrollment ends March 31, 2014. Here are five things you should know about the new Exchanges, also called the Health Insurance Marketplace.

1. There are four health plan categories – Bronze, Silver, Gold and Platinum

The Marketplace plans are separated into four primary levels: Bronze, Silver, Gold and Platinum.

The different levels are intended to meet various health and financial needs, and are based on the percentage that each plan pays towards health care services. The plan levels also indicate the percentage you will pay towards the health care you receive. Your portion of these costs is in the form of:

- Deductibles – the amount you owe for covered services before insurance kicks in;

- Copayments – a fixed amount you pay for a covered health care service; and

- Coinsurance – your share of the costs of a covered health care service.

This chart shows how much the different plans will pay of your health costs, not including premiums:

| Plan Level | What the Plan Spends | What you Spend |

| Bronze | 60% | 40% |

| Silver | 70% | 30% |

| Gold | 80% | 20% |

| Platinum | 90% | 10% |

The lower the amount of coverage, the lower the premium you must pay to maintain coverage. Bronze level plans have the lowest premiums, but also the lowest level of coverage. As the plan levels increase (from Bronze to Silver to Platinum), your monthly premium increases but so does the level of coverage. For example, you will pay a higher premium for a Platinum plan but you will pay less for each doctor visit, prescription, or health care service that you use.

Tip: If you expect to have a lot of doctor visits and require regular prescriptions, you may want to consider a Gold or Platinum plan. If you don’t expect to have a lot of health care bills, a Bronze or Silver plan may be appropriate. You will be able to compare plans on the Marketplace to find one that best fits your financial and health needs. Plans and costs vary by state and individual.2. All Marketplace plans must cover Essential Health Benefits

Regardless of whether you choose a Bronze, Silver, Gold or Platinum plan, certain essential health benefits must be covered and your copayments and coinsurance for them count towards your deductible. These services include:

- Addiction treatment

- Ambulatory patient services

- Care for newborns and children

- Chronic disease treatment (such as diabetes and asthma)

- Emergency services

- Hospitalization

- Laboratory services

- Maternity care

- Mental health services

- Occupational and physical therapy

- Prescription drugs

- Preventive and wellness services (such as vaccines and cancer screenings)

- Speech-language therapy

3. You might qualify for lower monthly premiums and out-of-pocket expenses

Many people will qualify for new federal subsidies that can help lower health costs, both the premiums and the care itself. When you get coverage through the Marketplace, you may be eligible for:

- Cost-Sharing Reductions, which help lower out-of-pockets costs such as deductibles, co-pays and coinsurance; and

- Advanced Premium Tax Credits, which reduce the amount you pay each month for your insurance premium.

- Ineligible for public coverage (Medicaid, Medicare and Children’s Health Insurance Plan)

- Unable to get qualified health insurance through an employer

In order to take advantage of Cost-Sharing Reductions, you must purchase a Silver plan on the Marketplace and your modified adjusted gross income (MAGI) must fall below these maximums:

FRom: http://www.investopedia.com/articles/personal-finance/091613/5-things-you-should-know-about-new-health-marketplace.asp

No comments:

Post a Comment